Cit Bank mobile deposit offers a convenient way to manage your finances on the go. This guide delves into the app’s features, security measures, troubleshooting tips, and user experience, comparing it to competitors and exploring its integration with other financial tools. We’ll examine the ease of use, security protocols designed to protect your funds, and address common issues users might encounter.

Understanding these aspects will empower you to confidently utilize Cit Bank’s mobile deposit service.

CIT Bank’s mobile deposit functionality offers convenient account management, allowing users to deposit checks remotely. This feature is particularly useful for those who have opened a savings account, such as through the process detailed on the cit bank open savings account webpage. The efficiency of mobile deposit complements the overall accessibility of CIT Bank’s digital banking services, enhancing customer experience.

From the streamlined interface to the robust security features, we’ll explore every facet of Cit Bank’s mobile deposit offering. We will also compare it to other banking apps and discuss potential areas for improvement, ensuring you have a complete understanding of this increasingly popular banking method.

Cit Bank Mobile Deposit: A Raditya Dika-Style Deep Dive

Okay, so you’re thinking about using Cit Bank’s mobile deposit, huh? Smart move. In this day and age, lugging around checks feels about as modern as using a rotary phone. But before you dive headfirst into the digital age of depositing checks, let’s unpack this whole thing, shall we? Think of me as your slightly sarcastic, but ultimately helpful, guide through the world of Cit Bank’s mobile check deposit.

Let’s get this bread (digitally, of course).

Cit Bank Mobile Deposit App Features and Functionality

The Cit Bank mobile deposit app? It’s… functional. Let’s just say it gets the job done. The user interface is pretty straightforward, like a really basic website from 2005. Nothing too fancy, but it’s not exactly painful to use.

Think of it as a reliable, if slightly uninspired, friend. You know they’ll be there for you, but don’t expect any fireworks.

| Bank Name | Feature | Description | Rating |

|---|---|---|---|

| Cit Bank | Check Deposit | Standard check deposit via mobile app. Pretty standard fare. | ★★★☆☆ |

| Competitor Bank A | Check Deposit & Remote Deposit Capture | Offers both mobile and remote deposit options, more flexibility. | ★★★★☆ |

| Competitor Bank B | Check Deposit with Image Enhancement | Includes image enhancement technology for clearer scans. | ★★★★☆ |

| Competitor Bank C | Check Deposit with AI-powered verification | Uses AI to verify check details and speed up the process. | ★★★★★ |

Depositing a check is a breeze, mostly. Just follow these steps:

- Open the Cit Bank app. (Duh.)

- Navigate to the “Deposit” section. (Usually pretty obvious.)

- Select “Mobile Deposit.”

- Endorse the check. (You know, the usual “For Mobile Deposit Only” thing.)

- Take a picture of the front and back of the check. Make sure it’s not blurry, okay?

- Review the details and confirm the deposit. Double-check everything before hitting that button.

- Wait for the confirmation. (The suspense is killing me!)

You can deposit most personal checks, but let’s be real, avoid those overly-creative, artistic checks. Keep it simple. Business checks? Maybe. But always check the app’s specific guidelines.

Image quality is key. A blurry photo is a recipe for disaster. Think crisp, clear images, like a well-lit selfie of your cat.

Security Measures for Cit Bank Mobile Deposit

Security is paramount, especially when dealing with your hard-earned cash. Cit Bank employs various security protocols to protect your data. They use encryption, multi-factor authentication, and other techy stuff that I don’t fully understand, but trust me, it’s there.

To prevent fraudulent deposits, Cit Bank uses image analysis and verification systems to detect anomalies. Think of it as a digital detective, constantly on the lookout for suspicious activity. They also monitor transaction patterns for unusual behavior.

The security verification process involves several steps, including image analysis, data encryption, and account verification. A detailed flowchart would be pretty complicated, but essentially, it’s a series of checks and balances to ensure that only legitimate deposits go through.

Potential vulnerabilities exist, like any system. Things like phishing scams, compromised devices, and network vulnerabilities are always a risk. Cit Bank mitigates these risks through regular security updates, user education, and robust security protocols. Always be wary of suspicious emails or links.

Troubleshooting Common Issues with Cit Bank Mobile Deposit

Let’s be honest, sometimes things go wrong. Technology is fickle, like a moody teenager. Here’s a quick guide to fix common problems:

| Error Message | Solution |

|---|---|

| Check image too blurry | Take another picture with better lighting and focus. Seriously, get a better photo. |

| Deposit failed | Check your internet connection, ensure the check is properly endorsed, and try again. If it still fails, contact customer support. |

| Connection Issues | Check your internet connection, try restarting your phone, and ensure you’re in an area with a good signal. |

Contacting Cit Bank customer support is relatively straightforward. Look for their contact information within the app, or check their website. They’ll usually have a phone number, email address, or online chat option.

If a deposit fails, don’t panic. Check the app for any error messages. If you can’t figure it out, contact customer support. They’ll be able to guide you through the process of recovering from a failed deposit.

Cit Bank Mobile Deposit: User Experience and Accessibility

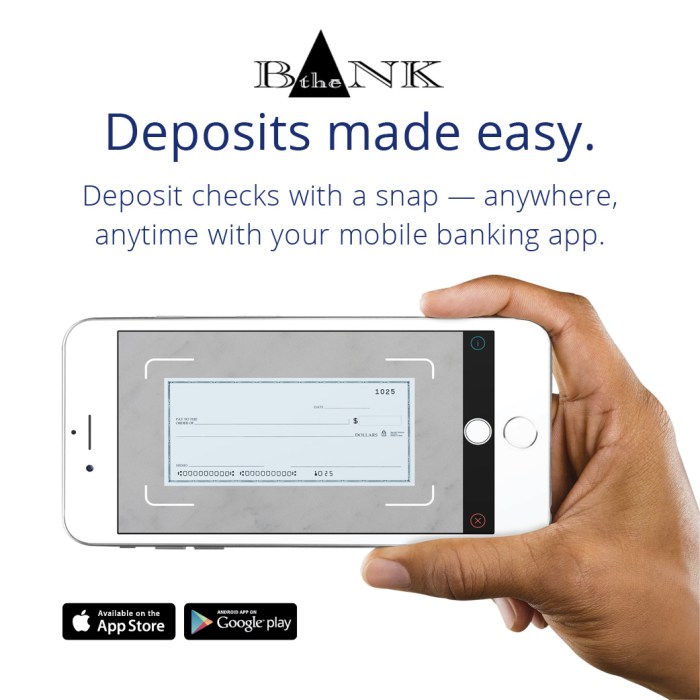

Source: thebank.bank

Let’s paint a picture of your average Cit Bank mobile deposit user: Probably someone busy, tech-savvy enough to use a smartphone, and possibly slightly stressed about managing their finances. They value convenience and security above all else.

Accessibility features are… present. The app likely includes features for users with visual or auditory impairments, though the specifics depend on the platform and app version. Always check the app’s accessibility settings.

User feedback varies, naturally. Some users find it easy and convenient, while others complain about occasional glitches or a lack of certain features. Improvements could include a more intuitive interface, faster processing times, and potentially adding more advanced features like OCR technology for automatic check information extraction.

App performance depends on your device and operating system. Generally, it should work fine on most modern smartphones and tablets. However, older devices or those with limited processing power might experience some lag.

Comparison of Cit Bank Mobile Deposit with Other Banking Apps

Source: atfcu.org

Compared to other major banking apps, Cit Bank’s mobile deposit is… adequate. It’s not the most innovative or feature-rich, but it gets the job done. Think of it as the reliable, if slightly boring, older sibling of the banking app family.

- Competitor Bank A: Offers more advanced features, potentially faster processing times.

- Competitor Bank B: Might have a more user-friendly interface.

Using Cit Bank’s mobile deposit is convenient, avoiding trips to the bank. However, it relies on a stable internet connection, and there’s always the risk of technical glitches. Other methods, like in-person deposits, offer more immediate confirmation, but lack the convenience.

Areas for improvement include enhancing the user interface, adding more robust security features, and integrating with more third-party financial management tools. Better integration with other financial tools would definitely make it more appealing.

Final Wrap-Up

Ultimately, Cit Bank’s mobile deposit functionality presents a valuable tool for managing personal finances efficiently and securely. While minor improvements could enhance the user experience, the app’s overall functionality, security measures, and ease of use make it a competitive option in the mobile banking landscape. By understanding both its strengths and potential areas for growth, users can leverage this technology to its fullest potential and enjoy a seamless banking experience.