CIT Bank APY Calculator: Unlocking the potential of your savings starts with understanding how interest works. This calculator helps you see exactly how much your money will grow in a CIT Bank savings account, considering factors like interest rates and how often your interest compounds. We’ll explore how it functions, compare it to competitors, and reveal the impact of compounding frequency on your overall returns.

Understanding these concepts empowers you to make informed decisions about your financial future.

This guide provides a comprehensive look at the CIT Bank APY calculator, explaining its functionality and helping you understand the factors that influence your annual percentage yield (APY). We’ll delve into the importance of compounding, compare CIT Bank’s offerings with other banks, and show you how to interpret the results to make better financial choices. By the end, you’ll be equipped to use the calculator effectively and confidently manage your savings.

Understanding CIT Bank APY Calculator Functionality

The CIT Bank APY calculator is a valuable tool for understanding the potential growth of your savings. It simplifies the calculation of Annual Percentage Yield (APY), which reflects the total amount of interest earned in a year, accounting for the effect of compounding.

Core Functions of the CIT Bank APY Calculator

The calculator’s core function is to determine the APY based on the provided inputs. It takes into account the interest rate, the compounding frequency, and the initial deposit amount to project the final balance after a specified period. This allows users to compare different savings options and make informed decisions.

APY Calculation and Input Parameters

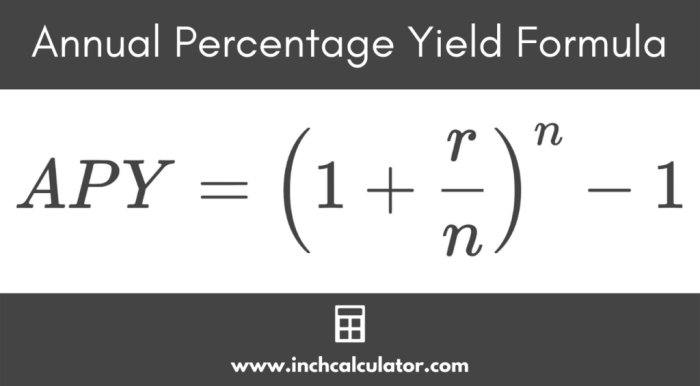

The APY is calculated using a formula that considers the nominal interest rate and the number of compounding periods within a year. The calculator requires the following input parameters: initial deposit amount, annual interest rate, and compounding frequency (daily, monthly, quarterly, or annually). The more frequent the compounding, the higher the APY will be.

Step-by-Step Guide to Using the CIT Bank APY Calculator

The following table provides a step-by-step guide on how to use a typical APY calculator. Note that the specific user interface may vary slightly depending on the version.

| Step Number | Action | Input Data | Expected Output |

|---|---|---|---|

| 1 | Navigate to the CIT Bank APY calculator page. | N/A | Calculator interface displayed. |

| 2 | Enter the initial deposit amount. | e.g., $1000 | Input field populated. |

| 3 | Enter the annual interest rate. | e.g., 4% | Input field populated. |

| 4 | Select the compounding frequency. | e.g., Monthly | Dropdown menu selection updated. |

| 5 | Enter the investment timeframe (optional). | e.g., 5 years | Input field populated. (If applicable) |

| 6 | Click “Calculate.” | N/A | Calculated APY and future value displayed. |

Comparing CIT Bank APY with Competitors

Comparing APYs across different banks is crucial for maximizing returns on savings. Several factors influence the APY offered, and solely focusing on APY might overlook other important considerations.

Comparative Analysis of APYs

The following table compares the APY offered by CIT Bank with three other major online banks. Note that these are hypothetical examples and actual rates may vary.

| Bank Name | Account Type | APY | Minimum Balance Requirements |

|---|---|---|---|

| CIT Bank | High-Yield Savings | 4.00% | $100 |

| Bank A | Savings Account | 3.75% | $0 |

| Bank B | Money Market Account | 3.50% | $2500 |

| Bank C | High-Yield Savings | 4.25% | $5000 |

Factors Influencing APY and Implications of Choosing Based Solely on APY

Factors such as market interest rates, the bank’s operating costs, and competitive pressures all influence APY. While a high APY is attractive, it’s important to consider factors like fees, minimum balance requirements, account accessibility, and customer service before selecting a bank based solely on APY. Overlooking these aspects might negate the benefits of a slightly higher APY.

Hypothetical Scenario: Long-Term Savings Growth, Cit bank apy calculator

Consider investing $5,000. Over 10 years, an account with a 4% APY would yield significantly more than an account with a 3.5% APY. This difference underscores the importance of even small variations in APY over the long term.

Understanding your potential earnings is key, and the Cit Bank APY calculator helps you do just that. To get a clearer picture of different options, you might also want to check out the current bank of america ira interest rates for comparison. Then, use the Cit Bank APY calculator again to see how those rates compare to your savings goals.

This helps you make informed decisions about your financial future.

Impact of Compounding Frequency on APY

Understanding compounding is key to maximizing savings growth. Compounding refers to earning interest not only on the principal but also on accumulated interest. The more frequent the compounding, the faster your savings grow.

Compounding Frequency and its Effect on Yield

The following bullet points illustrate how different compounding frequencies affect the final yield for a $1000 principal with a 5% annual interest rate after one year.

- Annual Compounding: $1000

– (1 + 0.05)^1 = $1050 - Quarterly Compounding: $1000

– (1 + 0.05/4)^4 = $1050.95 - Monthly Compounding: $1000

– (1 + 0.05/12)^12 = $1051.16 - Daily Compounding: $1000

– (1 + 0.05/365)^365 = $1051.27

As demonstrated, daily compounding yields the highest return, although the differences may seem small for a single year, they become substantial over longer periods.

Calculating Future Value with Different Compounding Frequencies

The future value (FV) of an investment can be calculated using the following formula: FV = PV (1 + r/n)^(nt), where PV is the present value, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years.

Scenarios Where Compounding Frequency is Most Significant

Source: inchcalculator.com

The impact of compounding frequency is most significant with larger principal amounts, higher interest rates, and longer investment horizons. The longer the money remains invested, the more pronounced the effects of compounding become.

Factors Affecting CIT Bank APY

Several factors influence the APY offered by CIT Bank. These factors are largely outside the control of the individual saver but understanding them can provide context for fluctuations in APY.

Factors Influencing CIT Bank’s APY

CIT Bank’s APY is influenced by market interest rates, economic conditions, and its own operational costs. Changes in the Federal Reserve’s interest rate directly affect the rates CIT Bank can offer. Promotional offers and special rates can also temporarily increase the advertised APY.

Impact of Federal Reserve Interest Rate Changes

When the Federal Reserve raises interest rates, CIT Bank generally has the ability to offer higher APYs to attract deposits. Conversely, when the Federal Reserve lowers rates, APYs tend to decrease.

Impact of Promotional Offers

Promotional offers and special rates can significantly impact the APY, often for a limited time. These promotions are used to attract new customers or reward existing ones, but they are not always sustainable long-term.

Impact of Changes in Various Factors on APY

Source: bankdealguy.com

The following table illustrates how changes in different factors affect the calculated APY. These are illustrative examples, and the actual impact might vary based on other variables.

| Factor | Change | Effect on APY | Example |

|---|---|---|---|

| Interest Rate | Increase | Increase | A 0.5% increase in the interest rate can lead to a noticeable increase in APY. |

| Deposit Amount | Increase | No direct effect | The deposit amount does not directly change the APY, but it affects the total interest earned. |

| Compounding Period | Increase (e.g., from monthly to daily) | Slight Increase | More frequent compounding results in a slightly higher APY. |

Interpreting APY Calculator Results

Understanding how to interpret the results from the APY calculator is crucial for making sound financial decisions. The calculator provides key information for comparing different savings options.

Interpreting APY Calculator Results and the Difference Between APY and Nominal Interest Rate

The APY calculator displays the annual percentage yield, which is the total return you’ll earn in a year, taking into account compounding. The nominal interest rate is the stated interest rate without considering compounding. The APY will always be higher than the nominal interest rate if compounding occurs more than once per year.

Using Calculated APY for Financial Decisions

The calculated APY helps in comparing different savings accounts and choosing the one that offers the best return. It allows for informed decisions regarding investment strategies and long-term financial planning.

Limitations of Relying Solely on APY

While APY is a valuable metric, it’s crucial to consider other factors such as fees, minimum balance requirements, and account accessibility when choosing a savings account. Relying solely on APY might lead to overlooking important aspects that could negatively impact your overall savings.

Ending Remarks: Cit Bank Apy Calculator

Ultimately, the CIT Bank APY calculator is a valuable tool for anyone looking to maximize their savings. By understanding how APY is calculated, the impact of compounding, and the factors that influence interest rates, you can make informed decisions about where to place your money and watch your savings grow steadily over time. Remember that while APY is a crucial factor, it shouldn’t be the sole determinant when choosing a savings account.

Consider other factors like account fees, accessibility, and customer service to make a well-rounded financial decision.